Earnings vs Cash Flow. A study in contrasts or a tale of two cities?

Analyst – “You are the only financial institution that cannot produce a balance sheet or cash statement with their earnings”.

This is a quote from ‘Enron – the Smartest Guys in the Room’ during an earnings call with Jeffrey Skilling (CEO) and Andrey Fastow (CFO). The snarky response from Skilling is classic but cannot be shared here for obvious reasons. The sad story behind the orchestrated collapse of this energy giant should be required reading (or viewing) for all MBA courses. The underlying lesson from all of the malfeasance is this – earnings without corresponding cash flow statements can be hollow and dangerous. While most companies would never find themselves in the nefarious position that the executives at Enron chose to put themselves in, the lesson can still ring true. Earnings + Statement of Cash Flows = The Whole Picture. Let’s examine a theoretical small business that suddenly finds itself in deep trouble even while their earnings appear to be impressive.

Fosters Landscaping is a highly successful business with multiple locations that is both a retail and wholesale supplier of landscaping material such as plants, chemicals, rock, dirt, tools, and trees. They’ve been in business for over a decade, with two locations and 11 employees.

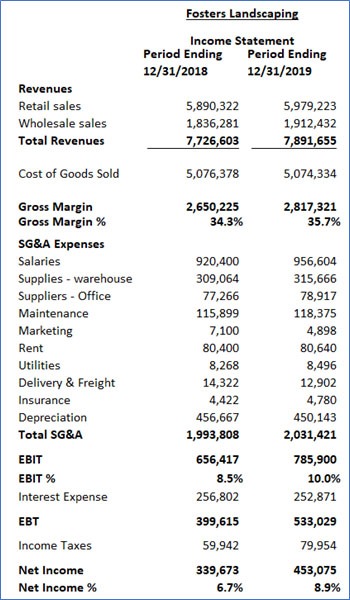

Consider their Income Statement.

Looks pretty healthy. Year over Year revenues growing at 2.1%, and with effective negotiation with vendors and product mix management, gross margin growing YOY at 4.1% (and improving as a %), and finally EBIT growing by almost 20%. Using the perspective of the income statement, this is a pretty solid business that is making all of the right decisions to get to this bottom line.

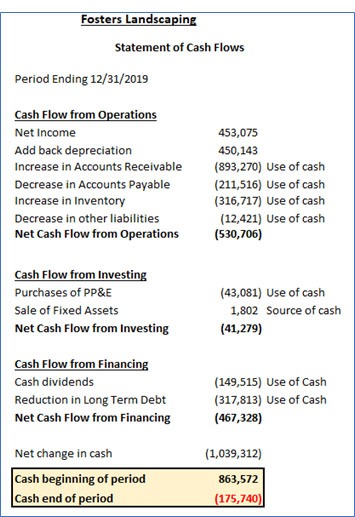

But wait. Let’s pop the hood and look inside at the cash flow engine. Here is the statement of cash flows for 2019.

Quite a contrast, isn’t it? How can a business that is ‘making money’ not actually make money? In fact, Fosters literally burned through over $1 million in cash, leaving them overdrawn and in trouble with their bank and paying their bills.

Let’s quickly explore the decisions and business conditions that could drive such a change?

- Cash Flow from Operations. This represents the day-to-day, core activities within a business that generate cash inflows and outflows. Net Income helps this statement get a strong running start, further boosted by adding back noncash expenses (depreciation). Noncash expenses are added back because the original cash was for the full fixed asset cost (which would have been in a previous period for Cash Flow from Investing), so this avoids the double dip in cash consumption. Where Cash Flow from Operations really falls off the cliff here is the increase in Accounts Receivable. The owners decided to allow several large contractors to carry 180+ day terms (previously 30-day terms) to capture the big sales, further exasperated by poor collection practices on the rest of the AR. In fact, if management oversaw the AR portfolio in a more disciplined manner, this would not be such a drag on cash. Increased AR is a use of cash, as others owe you. You are lending them money, for all intents and purposes. Conversely, Accounts Payable is a temporary loan to your business, carried by your vendors. While management was able to negotiate better structural pricing (manifested in the gross margins improving) with vendors, the new purchasing contracts shrank the payment terms pretty significantly. Finally, an undisciplined approach to Inventory Management shows significant impact to the Operational Cash Flow. Inventory sitting on your shelf is potential cash used and collecting dust, waiting to be bought and turned into real cash. Benchmarking against competitors and the industry would have been very helpful insight to understand if DSO, DPO, DIO were in line, and if improvements were needed.

- Cash Flow from Investing. Primarily Fixed Assets, aka Property, Plant & Equipment purchases. In this case, Foster Landscaping purchased a new delivery truck with cash, and sold the old one. Management not monitoring cash levels and flow can make these split-second decisions on capex purchases.

- Cash Flow from Financing. Typically, the most common areas here would be borrowing in/out and dividends paid. If a company took on a new loan, it would be a source of cash. In the exhibit above, Fosters chose to pay out dividends (on quickly dwindling cash reserves), and also paid down their promissory note with a bank as per the agreement. Both of these were significant uses of cash. If Foster would have secured additional debt (such as to pay for the new delivery truck) this would not be as acute.

So, to tie this sad story together – had Fosters monitored cash flow, and maintained specific financial policies meant to protect the liquidity, this picture would look very different. Intentional Accounts Receivable management, effective AP payment terms, and an inventory management system (with set order points) would have all avoided this cash disaster. Additionally, purchasing a fixed asset without understanding Free Cash Flow was short sighted. Finally, dividend policy is paramount to ensure that companies pay out cash surpluses only when other more optimized opportunities do not exist (stock buyback, NPV positive capex purchases etc.).

Having the right reporting software, and financial analytics tools and insight are not just important, but life sustaining for small businesses. Had Fosters leveraged the right suite of reporting tools, all of the above damage was entirely actionable and certainly preventable; and this whole sad story would have had a happy ending – one where a business is not overdrawn and out of cash.

For more information on how you can leverage the power of robust financial reporting software and or AI-Powered financial analytics software for the proactive CFO who is ready to get out in front of next year’s budget forecasts, reach out, we’re here!