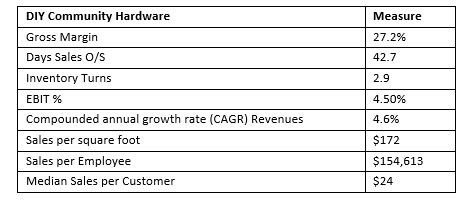

Consider the following scenario. A multi-generational Hardware chain with nine locations. Deep community roots and highly regarded as a full-service alternative to the big box stores. Management is pleased at how efficiently and well run the operations are. They are the go-to expert for retail customers and provide a variety of material for general contractors and builders. They are proud of their financial metrics and the financial analytics prove it out on just how hard they have worked to get here. A review of 2019 results yields the following key metrics.

These look pretty good, don’t they? A highly successful, liquid, efficient, profitable small business. The owners should be proud and can rest on their laurels.

But wait. Let us ask ourselves one thing. How do the owners truly know that this is as good as it gets? A business owner may already know their own business inside and out, but without benchmarking, there is no way to know and measure the unique processes of other businesses within your industry. Operating a business without benchmarking is akin to racing a car without looking out of the windows. You are not sure where everyone else is relative to your own position. By taking the time to use benchmarking tools to better understand how others are performing, you can see where your business may actually be lacking (or even outperforming). Strategically, businesses outperform their competitors by understanding their industry model, what basis they compete on, leveraging strengths, and mitigating weaknesses. Benchmarking is highly enabling of this.

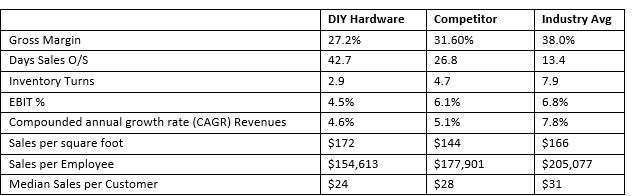

The owner of our example business would be surprised to get the following wake up call.

Some interesting contrasts here. Now, to be fair – many small businesses are right where they want to be. Their pricing strategy may be simplistic, asset management procedures tied to ‘how they’ve always stocked inventory and extended credit’, staffing based on everyone in the family has a job, budgeting isn’t an issue, etc., etc. There are likely multiple back stories within this comparative data. Some differences may be intentional whereas others may sting.

For instance, note Sales per Square Foot. DIY Hardware actually outperforms here. They keep their footprint intentionally very small. Also, note the Gross margin underperformance. Two things could be happening, both of which may warrant further analysis. Either DIY beats on price (which may also be manifesting on Median Sales per Customer), or the competition may source more effectively with their vendors. Either way, understanding this and determining if changes are needed would be the natural course of events once benchmarking data is unlocked.

Finally, note Inventory Turns. The low rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing efforts. Likely lots of dust on the shelves. This is actionable information. Without looking at your data vs. comparable businesses, you are operating in an information vacuum.

There are three types of benchmarking. Internal, competitive, and strategic.

- Internal benchmarking is when a company already has best practices and needs to ensure they are used as targets.

- Competitive benchmarking is when a company wants visibility of its position within an industry (or direct competitors), which is what I demonstrated here.

- Strategic benchmarking is used to identify and analyze world class performance and may not be industry specific.

Benchmarking is a powerful tool to promote a culture of continuous improvement within an organization. Be careful on relying on internal only measures, which can breed a myopic perspective. Be sure that your data is measured against financial performance for comparable, and most importantly, best in class companies. Understand what industry your organization plays in, leverage SIC and NAICS codes, and most importantly, ensure whatever analytics tools you leverage, that they have this benchmarking capability built in.