“We demand rigidly defined areas of doubt and uncertainty!”

― Douglas Adams, The Hitchhiker’s Guide to the Galaxy

Life is full of uncertainty. That is part of the fun of our existence. We don’t really know what is around the next corner, but most of us are mentally prepared in some form or another. Within our life, we try to mitigate risk, and we chase opportunity. Business isn’t so fundamentally different. Many companies now have a ‘Chief Risk Officer’ who is actively involved in strategic decision making and an ongoing dialogue with the C suite. Boards and executives play a part in shaping risk appetites and ensuring the right infrastructure and tools are in place to manage risk. So, awareness, strategy, policy, and process exist in modern business to embrace and manage risk.

But what is risk? In the business world, it refers to the potential of an organization to face unknown factors that may impact its profits, and at the most draconian – fail. Risk can come from a variety of sources, so its not always an internal snafu or miscalculation that is to blame. Risks can come from any direction or dimension. They can be internal, external, macro, customer, technological….the list goes on and on.

How should Finance and FP&A think about risk? Additionally, how should they think about opportunity? After all, at the end of each fiscal year, many companies are busily wrapping up their annual Budget. But how can we approach and live in a world where even the best economists cannot accurately predict the future even with massive amounts of information or solid financial analytics to parse through? Ultimately, the only thing an organization can really accept is that they should budget with the best information available, accept the uncertainty, and adapt/respond very quickly as the future unfolds using policy, process and procedure (the 3 P’s). This mindset is the basis for scenario planning (which will be a future blog post) and R&O (Risk and Opportunity) integration with quarterly re-forecasting.

Many organizations will take a pause quarterly to reflect on what has happened (actuals) in terms of financial results. Much soul searching is done each time as the realization that ‘not everything predicted in October and approved by the board in November’ comes to fruition. This may explain why more and more companies have embraced both rolling forecasts (12-18-month forward looking forecasts regardless of calendar year) and quarterly (re)forecasts – X months actual, with Y months revised, given better recent insight. Quarterly re-forecasts may just encompass to the end of the calendar year or may go several years into the year following. Regular quarterly forecasting helps to quantify and by implication manage, the gap between the original board approved budget and the reality of where the company is truly headed, given the latest insight. It facilitates ‘get well plans’ with enough time to act upon and ensure that the original budget is still safe and relevant, albeit the components may look different.

To address this ‘best practice’ of staying dynamic with quarterly forecasting, an additional layer of forecasting is needed. Risk and Opportunity matrices are a very helpful tool to gather, monitor, quantify, inform, and ensure that material deviations from the budget (or even previous forecast) are maintained and well researched each month. Think of this as the ‘notebook’ of all items that the organization is aware of that were unexpected, or where significant deviations from original assumptions are expected. This tool should be continuously maintained, reviewed regularly, and inform the next quarterly forecast of items to include, exclude, or significantly alter existing revenues or costs, given new intelligence.

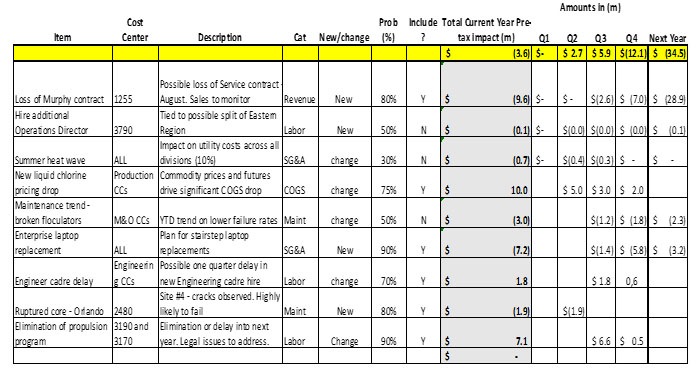

Below is a generic example of an R&O matrix, maintained and shared by designated Finance Directors.

This tool may be intuitive to some practitioners, but in a nutshell – this is how to interpret this matrix.

Item – The discrete event or trend to highlight.

Cost Center(s) – Self-explanatory. May impact entire organization. Isolating out the expected CC impact is crucial if this event is to be woven into the next Forecast.

Description – Layman’s terms defining the item, and why it is considered a risk or opportunity.

Cat – Category of Income Statement that is expected to be impacted by the event.

New/Change – Is this a new event (i.e., the Income Statement had no components of the event in its detail), or a change? (costs are in Income Statement, but the scale is expected to be materially different).

Prob % – Estimated probability of occurrence. This should be continuously maintained as better insight is gained to move towards 100%, or towards 0%. If an event reaches 0%, it’s a good practice to keep on the matrix to maintain history and outcome.

Include? – Should the item be included in the next forecast – meaning adjust some area of the P&L to reflect. Note that this example has Y for high probability events.

Total current year pretax impact – How much this event or trend is expected to impact the organization. Note that this is carved up by quarter (Q) and also has a column for next year impact (which may be a guide to flow into the next year budget or consider for rolling forecasts that cross the EOY line).

In managing a forecast, it is crucial that the total impact of the items to roll into the next forecast be quantified before inclusion. Many firms tend to put in only the bad guys and leave the good guys out for ‘upside surprises. This is not just a poor practice, especially in publicly traded firms, it can be dangerous. Upside EPS misses can be as problematic as downside misses. If the risk is all downside, business unit directors and leaders should formulate operational plans to heal the downside. Those plans should go into the forecast alongside the ‘bad guys’ so as to balance out and bring the consolidated budget back to the original approved budget.

Using an R&O Matrix in unison with quarterly forecasting and budgeting, and even more crucial – scenario planning (because the future can unfold in infinite directions) ensures that an organization is not stuck with a static, stale, unachievable budget – and can react and course correct on the fly.