In part one, we will look at how today’s CFO can leverage the existing tools and resources within the finance organization so that he or she can take control of their organizations’ finance transformation journey. For the future-ready finance department – see how the CFO can use data and analytics to stay above the fray and still move the needle.

Part I

Every day, CFOs far and wide will pause, reflect and ask themselves, “Am I using everything within my power to position the organization to operate at its fullest capacity?” If the answer is yes, then there’s no reason to read any further and congratulations are in order as you are in a unique club comprised of one member. For the rest of the CFOs out there, here are five not-so-secretive finance functions that could, if leveraged properly, take their respective organizations to the next level.

Analytics

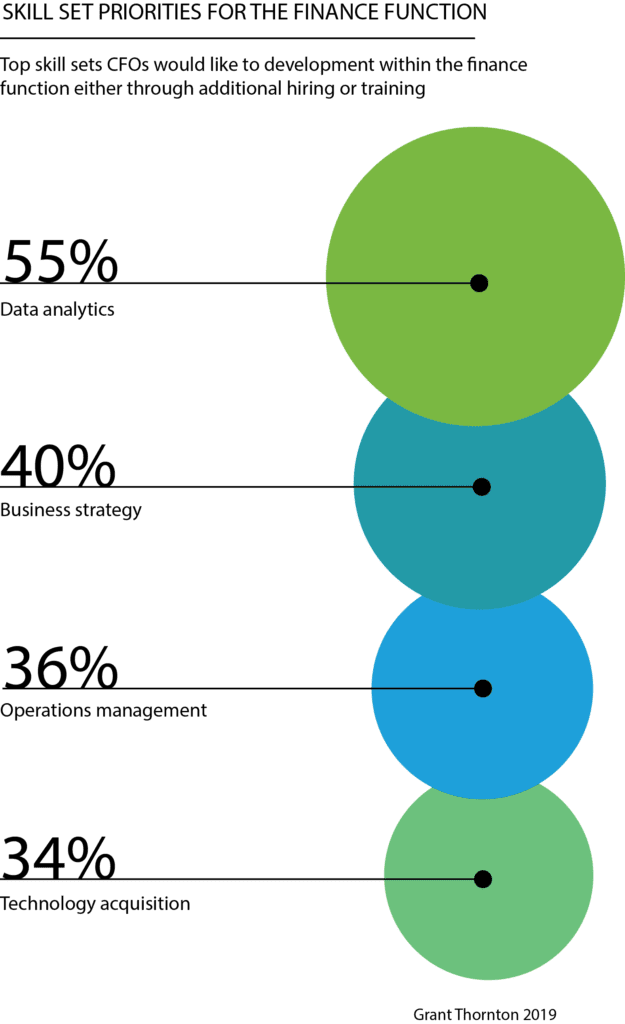

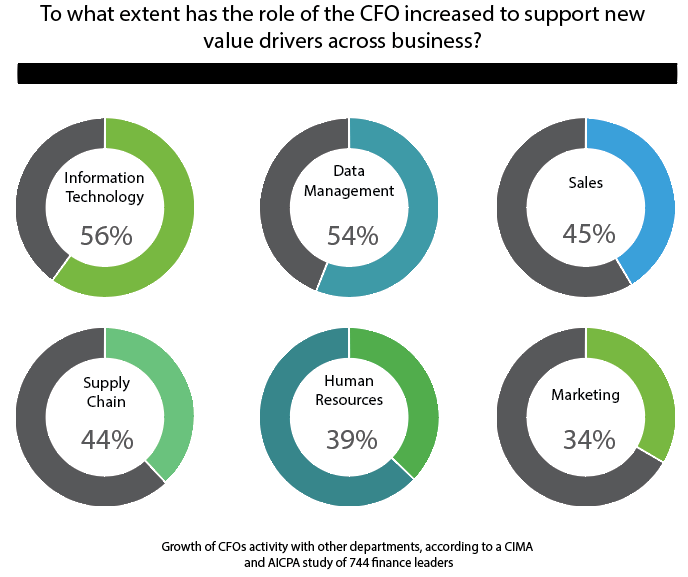

Let’s face it, the CFO has become the de facto leader of digital and business transformation. With that in mind, they now need to take the lead on things that ten or fifteen years ago would have been unheard of. They and their respective teams need to be the Lewis and Clark (and Sacagawea) of providing guidance to help everyone within the organization make the best possible business decisions while still exploring and uncovering opportunities in parallel. As the logical, if not natural, owner of Big Data, CFO’s now have the added responsibility of making informed choices which can and will influence everyone. This includes everything from accounting and core finance decisions to supply chain issues, as well as sales and marketing and even HR. By analyzing data patterns, uncovering the right numbers, and sharing the stories behind them, CFOs and finance teams can provide the key insights to the C-suite that can inform and influence smarter business-wide decisions.

In addition, as finance and analytics software suites become more common, sophisticated and affordable, access to a broader range of tools such as automation, business intelligence and integration will become more pervasive. Therefore, it will be more manageable for finance to lead the charge in analyzing data more effectively to offer valuable, real-time, business insights at the speed of now. As the CFO leads the adoption of analytics, time spent on data consolidation will cede power and control to data analysis with a similar shift in its value to the organization.

Data (the non-financial kind)

Depending on who you talk to, technology today is no longer a barrier to data consolidation. Every bit of data being collected can now be used to tell more of a comprehensive story. This applies especially to the use of non-financial data in traditional planning and reporting, which can offer a true holistic look in terms of what is working — and what is not — for the business.

As finance teams become more the centerpiece of organizational decision-making, CFOs and finance teams will be able to integrate more and more non-financial data into their analysis to deliver a more substantial look at the state of their organizations. This, in turn, will enable them to make better and more informed decisions that can propel the company forward. For example, combining big (unstructured) non-financial data with Fintech capabilities is becoming increasingly popular. Why? Because of the insights. At its most basic level, unstructured communication like emails, social media, chat sessions, voice and video recordings all lend themselves to unstructured summaries of communication that can possibly influence finance decision making and competencies.

As data volumes increase, data streams become more and more real-time and complex (both structured and unstructured), but so does the desire and need to analyze and understand it as well. The key to unlocking the insights of unstructured or non-financial data will be converting that data into structured data as it resides on corporate networks, within collaboration tools, and in the cloud. However, it can sometimes be extremely difficult to identify, interpret or even locate.

In addition, as organizations of all sizes continue to evolve, all types of data are now being utilized in ways that previously were unimaginable. For the CFO who wants to understand their markets and customers in a more in-depth way, and to stay one step ahead of the competition, unlocking non-financial data is one of the keys. With the right practices in place, getting a true holistic view of the organization, its customers and its competition, is now a viable, attainable reality.

In part II, we’ll discover why data is the center of the finance universe and why predictive analytics and insights can be an essential commodity and the much needed fuel to spark the future vision of the CFO.