Did you know that spreadsheet programs, like Excel, were not designed to be used as financial reporting software? By using Excel-based financial reporting software, CFOs are welcoming a wide range of risks into their companies, which can lead to inaccurate financial statements. No one wants that! Finance leaders must be able to ensure that their financial reporting is not compromised by potential errors within a company’s reporting solution, which is why more and more finance chiefs are migrating towards cloud-based solutions.

Cloud-based financial reporting solutions offer the benefits of remote access, which reduces the time needed to manually adjust data in order to accommodate multiple entries from different locations and many users. The sooner real-time information is available throughout the organization, the better the decision-making will be.

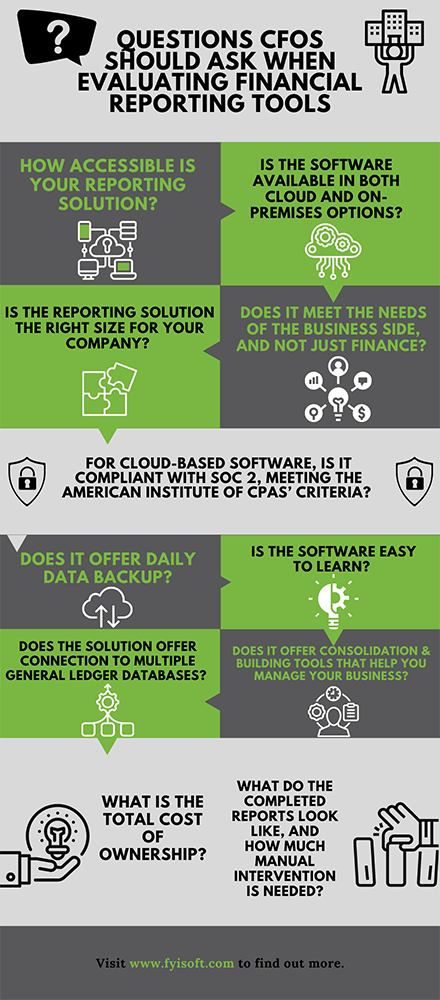

There’s a lot to think about when it comes to evaluating financial reporting tools and figuring out which one is best for you and your company. Here are 11 questions that a modern-day CFO should be asking about financial reporting software…

- For cloud-based software, is it compliant with SOC 2, meeting the American Institute of CPAs’ criteria for data security, availability, processing integrity, confidentiality, and privacy as determined by a third-party auditor?

- Does the solution offer daily data backup?

- Does the solution offer report writers capable of connecting to multiple general ledger databases and consolidating that data into one P&L statement and balance sheet?

- Does it offer report writers that add value for your company, consolidating data and building tools that help you manage your business, and not just satisfy audit requirements?

- Is the software available in both cloud and on-premises options?

- How accessible is the reporting solution?

- Is the software easy to learn? Does the implementation training take days or weeks, or hours? Is it intuitive, using the language of the finance staff, or does it require IT staff interpretation and coding skills?

- Is the reporting solution the right size for the company, and is it scalable?

- Does it meet the needs of the business side, and not just finance? How easy is it for the business managers to put the data in, and how easy is it for them to extract knowledge?

- What is the total cost of ownership, including maintenance, customization, upgrades, implementation, and training? Are there price breaks for certain numbers of users, and what will the projected cost be as the company grows?

- What do the completed reports look like, and how much manual intervention is needed to format them for board reports, auditors, or SEC filings?

Automated financial reporting solutions, including cloud-based solutions, enable faster and smarter business decisions and allow for CFOs and finance teams to focus on business innovation and strategy. Don’t you want to save yourself and your team the time and trouble?

FYIsoft is proven to cut financial reporting time by up to 50%, even in complex multi-entity or global currency environments. With over 8,500 global users and SOC 2 certified, FYIsoft is a leading provider in cloud financial reporting software. Schedule a brief demo with us today!